The Hidden Costs of Verification: How Traditional Diploma Check Methods Hurt Your Budget

Author:

Artem Grigoriev

Author:

Artem Grigoriev

- What Are the Direct Fees for Manual Diploma Verification?

- How Do Labor and Overhead Inflate Verification Costs?

- Why Is Physical Document Storage a Major Hidden Cost?

- What Are the Financial Risks of Slow Verification Processes?

- How Much Can Automated Verification Systems Reduce Costs?

- How Does a Modern, All-Inclusive System Compare on Cost?

- Summary: From a Financial Drain to a Strategic Asset

When you see that $15 or $30 invoice for a diploma check, it seems simple enough. Just another predictable line item in your budget, right? But what if that price tag is just a distraction? What if it's hiding a much bigger, more damaging financial drain?

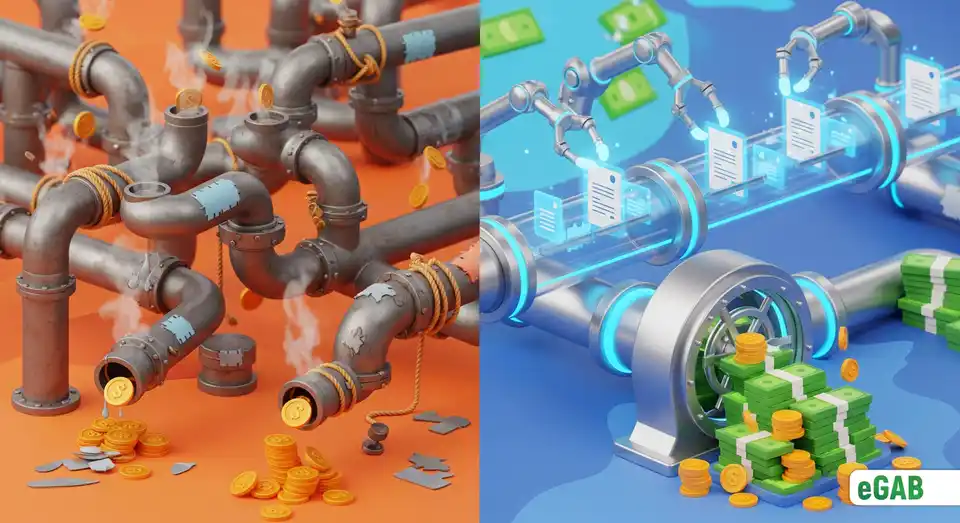

Let's be honest. Traditional diploma check methods are loaded with huge hidden costs. These hidden costs of verification are quietly wrecking your company's bottom line. They come from wasted labor, slow hiring, and serious compliance risks. In this article, we're pulling back the curtain. We'll break down exactly how these outdated methods hurt your budget. You'll see where the real expenses are hiding and learn what they're actually costing you.

📘 This post is part of our comprehensive guide to "eGAB:The Global Academic Blockchain Ecosystem for Digital Credentials". Explore it to find answers to all your questions ;)

What Are the Direct Fees for Manual Diploma Verification?

Let's start with the most obvious expense: the direct fees you pay for each diploma check. So, how much does manual diploma verification cost? These per-check costs can vary a lot-and the range might surprise you. While you might see fees as low as $7.60 , they can easily climb as high as $35 . For any company, these manual diploma check fees are just the first financial hurdle.

To put this in perspective, think about the U.S. Here, verifying a degree through the National Student Clearinghouse can cost you $19.95 before they even add on any surcharges (extra fees). Over in the U.K., the HEDD service charges a flat £14 . The price also changes depending on the school. For example, a service like Parchment might charge $7.60 . But if you go directly to an institution, a manual check at a school like William & Mary could run you anywhere from $12 to a shocking $90 . That shows you just how much these prices can really vary.

Now, imagine you're a company processing hundreds of these checks every year. Even at the low end of $7.60 a check, that number adds up fast. You could easily be looking at over $7,600 in annual costs. And while that's definitely a big hit to the budget, it’s only the tip of the iceberg. These direct fees often distract you from the much larger hidden costs of diploma verification that we're about to dive into.

How Do Labor and Overhead Inflate Verification Costs?

While direct fees are high, the real damage to your budget actually comes from hidden costs like labor and overhead -the indirect costs of running your business, like employee salaries and office space. So, what are the hidden costs of employee background checks? It’s all about the valuable staff time your team wastes on tedious, manual work. This one factor alone can inflate your total expenses by a massive 30–50% , mostly from sky-high labor costs in verification . These spiraling employee verification costs are where the real financial drain hits you.

Just look at the numbers. A major study by IDC (International Data Corporation) found something shocking. The average employee loses an incredible 21.3% of their productivity just from dealing with document problems. For your business, that translates to a staggering cost of about $19,732 per employee, every single year . So, how long does manual employee verification take? For every single request, someone on your team spends 15–20 minutes on mind-numbing tasks like handling paper forms, checking IDs, and processing payments.

And what happens when a simple mistake pops up, like a typo in a name or a missing date? That one error easily wastes another 10 minutes . The financial hit from these seemingly small moments of human error is shockingly high. In fact, research from PricewaterhouseCoopers (a major global accounting and consulting firm) on document management shows a single misfiled document costs you an average of $125 just in wasted time. If that document gets lost completely, you’re suddenly looking at a replacement cost between $350 and $700 .

Here's a sobering statistic: about 7.5% of all paper documents are lost entirely -a problem made even worse by the fact that a PDF diploma doesn't protect against fraud. When that happens, a shocking 83% of employees have to recreate those lost documents from scratch. It's a vicious cycle that wastes a massive amount of time and duplicates effort.

Why Is Physical Document Storage a Major Hidden Cost?

On top of the processing costs, you've also got another major hidden expense: physical document storage. The physical document storage costs for keeping paper records are way more expensive than most people think. In fact, that same PricewaterhouseCoopers research found that it costs your business around $25,000 just to fill one filing cabinet. On top of that shocking initial cost, you’ll also pay another $2,100 every year just to maintain it.

This need for physical space translates directly into huge real estate costs -the price of the office space you're using for storage. Think about it: in a prime spot like London's West End, the space for just four filing cabinets could run you over £1,527 per month . Even in a city like Manchester, that’s still £5,850 a year -all just to store paper. And it gets even tougher with sensitive credentials. They need secure, climate-controlled storage to maintain compliance (following the official rules). For that kind of specialized storage, you can expect to pay anywhere from $1 to $5 per square foot per month , a figure that could easily double your already high real estate bills.

What Are the Financial Risks of Slow Verification Processes?

Beyond the direct costs, the price of delays is enormous. So, what are the risks of a slow hiring process? Slow, manual verifications can easily drag on for 2–4 weeks , often thanks to university backlogs (a pileup of requests at schools) or simply waiting for physical mail. These slow verification process risks don't just delay critical hiring decisions; they trigger a damaging domino effect of lost productivity across your entire organization. This directly inflates your time-to-hire , a key metric that torpedoes your competitiveness.

When you're trying to fill a key role, every delay is incredibly costly. The cost of hiring delays is clear: a pushed-back start date can cost your company between $500 and $1,000 per day in lost output and weakened project momentum. The impact on your projects can be just as damaging as the direct financial loss. A slow background screening process also gives top candidates a perfect reason to accept an offer from your faster-moving competitors.

For businesses in regulated industries like finance and healthcare, the stakes are even higher. A failed or inadequate verification isn't just an inconvenience; it's a serious compliance risk . The compliance risks in hiring can be shocking and could expose your company to lawsuits for negligent hiring . As global compliance experts warn, the consequences of non-compliance can be devastating. This brings us to the real question: what is the cost of non-compliance in hiring? Breaking critical rules like GDPR (General Data Protection Regulation), the FCRA (Fair Credit Reporting Act), or anti-money laundering (AML) laws can lead to huge fines. You could face staggering penalties of up to €20 million or 4% of your global turnover . Compared to that, the initial verification fees seem trivial.

How Much Can Automated Verification Systems Reduce Costs?

The answer to these nagging problems is automated verification systems , which deliver tangible benefits for universities, students, and employers. If you're asking, " How can I reduce hiring verification costs? ", automation is your clear answer. These modern platforms don't just cut your third-party fees; they almost completely get rid of time-sucking manual labor. The difference between manual vs automated verification costs is night and day. Because of this, they can slash your total per-check cost by as much as 40% . True workflow automation takes care of all the repetitive jobs, so your team can focus on work that really matters.

The effect on your labor overhead (what you pay your employees) is huge. In fact, some studies show an 80% reduction in manual processing work. This is where you'll find incredible automated verification system savings . Let's put that in real numbers: a task that used to cost your business $12.50 in staff time now costs as little as $1.00 . That agonizing 2–4 week wait? It shrinks to just minutes. This incredible speed helps you drastically shorten your time-to-hire (the total time it takes to fill a job), meaning you can finally stop losing productivity and reduce employee verification costs in a big way.

On top of that, automated systems tackle the problem of expensive human error head-on. So, how do automated systems improve verification accuracy? With manual data entry, the error rate can climb as high as 15% . When you bring in an automated system, that error rate plummets to less than 2% . This boost in accuracy improves your overall data security and makes your entire credentialing process stronger. This allows you to stop wasting precious time and money on fixing mistakes and redoing work.

Why It Matters: So, is automated credential verification worth it? Absolutely. When you switch from slow, mistake-prone manual checks to a fast, accurate, and secure automated system like the eGAB global academic blockchain, you're not just cutting fees. You're completely transforming your operational efficiency, lowering legal risks, and giving your team the power to hire top talent faster. It’s a strategic investment with a return you simply can't ignore.

How Does a Modern, All-Inclusive System Compare on Cost?

Forget high, unpredictable per-check fees. The innovative eGAB ecosystem gives you a remarkably clear and competitive pricing model. We make this happen with our specialized CREST Chain technology, complete technological independence, and fully automated end-to-end processes that completely redefine blockchain verification .

You get the complete package for a single, transparent price. This includes secure NFT credential issuance (creating a unique, unforgeable digital diploma on a blockchain) on our proprietary (we own and developed it) CREST Chain . Each NFT credential becomes a permanent, verifiable asset for the recipient. You also get lifetime hosting on a powerful platform with TOP-3 Google visibility , plus the priceless peace of mind that comes from built-in trust services. These essential services, which run on blockchain, TTP, and CA technologies, are provided by a Trusted Third Party (TTP) (an independent body that verifies information) and a Certification Authority (CA) (an entity that issues digital certificates to prove identity).

Crucially, there are absolutely no hidden charges. You'll never see extra fees for blockchain transactions, commonly known as "gas." We don't charge for software access, annual subscriptions, or ongoing maintenance. Plus, your plan includes complete technical support.

We provide two straightforward plans designed to fit your specific needs:

-

The PRO Plan , starting at just $0.25 per document , is perfect for institutions that want to manage the issuance process themselves.

-

Or, if you'd rather we handle everything for you, the VIP Plan is our fully managed "white-glove" service (a premium, all-inclusive service where we do all the work). With this plan, we manage the entire process for you, starting at just $0.50 per document .

At eGAB, we believe in showing you our value, not just talking about it. That's why we have special offers for our new institutional partners and large educational organizations. These offers include up to 100 free NFT credentials to help you experience the system's incredible value firsthand.

Summary: From a Financial Drain to a Strategic Asset

So, what’s the final verdict on diploma verification? We've painted a pretty clear picture. Relying on traditional, manual methods is like trying to fill a leaky bucket-it's just not working. The problem goes far beyond the obvious direct fees , which themselves can run you anywhere from a manageable $7.60 to a steep $35 for every single check.

The real financial damage comes from something else entirely: the massive, often-overlooked hidden costs of diploma verification lurking just beneath the surface. We’re talking about staggering labor costs . Just think about the huge productivity losses and the valuable time your team spends on manual processing. This alone can inflate your total expenses by a shocking 50%, which could mean you're losing nearly $20,000 per employee annually .

And that's not all. You also have to factor in the outrageous physical document storage costs . A single filing cabinet can cost an incredible $25,000 just to fill, and then another $2,100 every year just to maintain it. When you look at these numbers, the true price of sticking with outdated methods becomes painfully obvious.

On top of these huge operational drains, slow verification process risks create a domino effect of lost opportunities. The typical 2–4 week delay drags out your time-to-hire, costing your company the best candidates. The bottom line? You could be losing between $500 and $1,000 per day in productivity.

Even more alarming are the severe compliance risks in hiring that come with these delays. In a regulated industry, one misstep can trigger devastating fines for violating critical data privacy laws like GDPR or the FCRA. We're talking about potential penalties that can soar as high as €20 million . Suddenly, a simple background check transforms into a massive potential liability.

This is exactly where automated verification systems come in to completely change the game.

When you switch from slow, error-prone manual work to a streamlined digital process, the benefits are massive. You can slash your total per-check costs by up to 40% , cut your need for manual labor by an incredible 80% , and best of all, shrink verification times from weeks down to mere minutes.

The eGAB ecosystem's solution is the pinnacle of this evolution. This system doesn't just automate old processes; it introduces a completely transparent, all-inclusive model built on its proprietary CREST Chain .

Here’s the bottom line: there are absolutely no hidden "gas" fees or recurring subscriptions. With plans that clarify the cost of issuing NFT credentials-starting at just $0.25 per document -it’s a total game-changer. Verification stops being a costly, risky chore and becomes a secure, efficient, and strategic advantage. Understanding the ROI of NFT credentials is how you protect your budget and fuel your company's growth.

➡️ Ready for a technical breakdown? Beyond just being expensive, traditional methods are dangerously insecure. Let's dive into the vulnerabilities of a standard document format and see why a PDF diploma fails to protect against fraud.

Diploma Forgery Statistics for 2025: The Latest Trends and Shocking Figures

The Axact Case: Anatomy of an International "Diploma Mill"

Choosing a Blockchain for Academic Credentials: A 2025 Comparison Guide

Why Leading Universities Choose eGAB for Issuing & Managing Digital Credentials

The Tangible Benefits of eGAB for Universities, Students, and Employers